I couldn’t head off for the break without adressing the recent New York Times (NYT) article which covered the 2025 uncertainty in NIH funding. There’s a lot we can talk about in there, but here I’ll dig into what this could mean for those selling to scientists.

The article, which you can find in full here (paywall), covers several points about NIH funding, the turbulence in FY 2025, and what it means for the future.

The main points you need to know are:

- Upfront payment of grants are becoming more common.

- There are shorter grant lengths with researchers having ~2 years less to spend the money.

- The trend may continue into FY 2026.

These changes are the result of White House directives to fully fund research grants meaning a whole project is funded straight away, rather than NIH’s historical practice of awarding a grant in annual installments.

There is still uncertainty around how this will all play out and what % of grants will be impacted, but here are the potential implications for science sales and marketing teams.

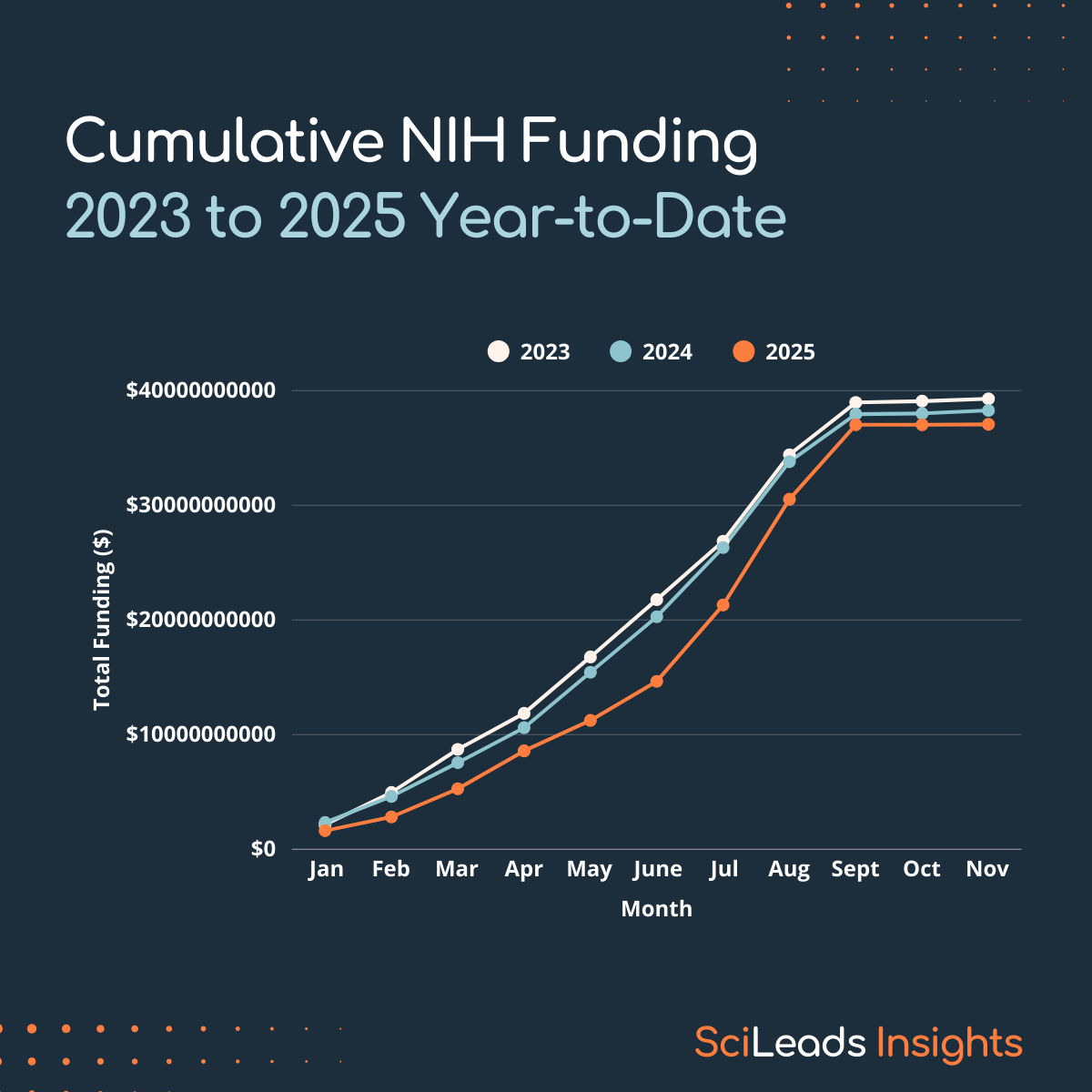

We regularly share updates on NIH funding – follow me on LinkedIn here or get our newsletter for these.

The Potential Impact on Scientists Purchasing Behaviours

If researchers start receiving NIH grants under these new terms they will receive a larger amount of money upfront, but need to spend it faster.

One logical step is that large equipment purchases could become smoother, with greater amounts of funding available at the beginning of a project. However the increased pressure on speed would make delivery lead times a more important factor in purchasing decisions.

Small- and medium-sized equipment could see a real boom for 2 reasons. Investment into everyday workhorses like balances, centrifuges, or PCR machines allows buyers to store the fleeting cash as tangible, useful assets. It would also reduce bottlenecks – with tighter deadlines, you don’t want to queue for key pieces of equipment.

If there is a general move to larger upfront deals and tighter deadlines, buyers showing risk aversion and prioritizing speed is expected. This could play out as;

- Bundle orders – including (more) maintenance or consumables while they have the cash, increasing first order value.

- Flexible delivery – depositing credit with consumable suppliers, to draw down smaller shipments over time.

- Volume pricing – with the funding guaranteed there may be requests for larger volumes in one order, and the expectation of more favourable pricing for locking in.

- Convenience products – pre-mixed reagents, ready-to-use kits, or multi-channel instruments could become more popular with time prioritized over money.

- Consolidating suppliers – reducing admin and perceived risk by working with fewer, known suppliers.

- Procurement speed – expect more requests for W-9, policies, soul-source justification, and other documents that are needed today. Vendors who make the quoting and purchasing process feel easy will likely be favoured as speed is prioritized.

- Decision-making speed – comparisons, demos, evaluations need to happen fast. Timing will be everything. Suppliers need to show up, ready with the right products, the right proof, and the right support. Building relationships before funding is announced and showing up quickly when a researcher gets a green light will be more crucial than ever.

- Product Ecosystem Preference – using the hardware, software, consumables, training, and service from the same brand or vendor will be favoured, as this reduces risks of incompatibility and gives faster speed to results.

- Risk-Averse Purchasing – products with clear validation, citations, and reference customers will be favoured, as the key mentality of “speed to results” prevails.

- Delivery Speed – lead times, reliable delivery, and reliable service/support/repairs will be highly valued.

If projects shift to being funded with larger sums of money upfront, it becomes even more important to have early visibility of the labs and researchers winning awards.

We will continue to track NIH data and trends and will post deeper dives as FY26 data is released. Follow us on LinkedIn here or get our email newsletter here.

And be sure to set your alerts in SciLeads so you’re notified of new funding in your space!