So many of you selling and marketing to scientist buyers told us your results, strategies, and predictions for 2026 in our survey. This report presents the key results and industry-specific benchmark figures for those selling scientific instrumentation, equipment, and consumables. We also give our key recommendations for targeting scientific buyers this year, and resources to learn more about sales and marketing strategies in science.

Prefer a PDF? Grab it here. (Content is the same as on-page)

Jump to:

- Summary

- Demographics: a look at who responded, and who these results are for.

- Challenges and Check-In: the factors impacting results, top reasons for lost deals, plus your outlook and predictions

- Pipeline: lead sources, and where deals stall.

- Prospecting: average open and reply rates, and what top performers are doing differently.

- Events: how people happy with conference ROI source and handle events.

- Marketing: the tactics you’re using in 2026.

- Tools & Tech: the key tools and technology recommended by you.

- Recommendations: what to change in 2026 to succeed when selling to scientists.

- Appendix: full list of the tools recommended by respondents.

Summary

This year’s survey revealed optimism in the face of challenges, and that truly connecting with your scientist buyer’s work drives the best results.

People across sales and marketing, all targeting scientists, shared their thoughts and results anonymously in the survey. A huge thank you to everybody who shared their experience so candidly.

Common challenges identified included;

- Growing targets coupled to stagnant team sizes and budgets

- Political headwinds (NIH funding and tariffs)

- ROI from conferences, and

- Getting team alignment on tools and tech to use.

Winning tactics identified included;

- Using a wider variety of channels in prospecting

- Staying politely persistent in your follow-ups

- Personalizing messages with context of the individual’s work (not the company’s work), and

- Doing pre-work before conferences.

In the coming report we examine the full results and give recommendations to succeed in 2026.

Demographics: Industry Specific Results

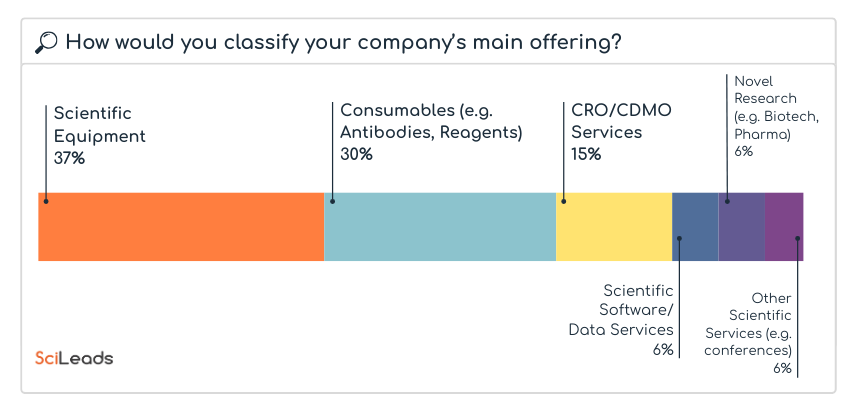

Our main goal with this survey was to collect insights only from those selling to scientists.

There are tonnes of data out there from consultants, email providers, and many other sources – but selling to scientists is different. These are highly expert and sceptical customers, whose environment, ways of working, and ways of purchasing are unique, who need their own category.

This report contains only results from those selling products and services to scientists. You can see the precise breakdown below.

This report is for those selling to scientists. Survey respondents were asked; How would you classify your company’s main offering? 37% chose Scientific Equipment, 30% Consumables (e.g. antibodies, reagents), 15% CRO/CDMO services, 6% Scientific Software and Data Services, 6% Novel research (e.g. biotech, pharma), and 6% Other Scientific Services (e.g. conferences)

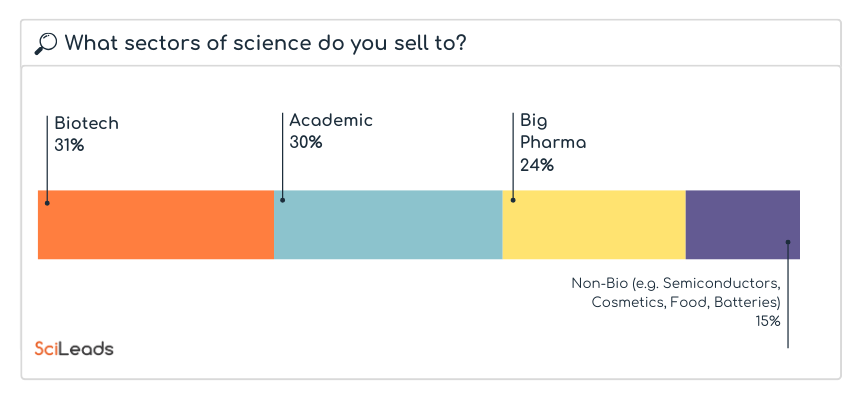

Survey respondents were asked; what sectors of science do you sell to? 31% said Biotech, 30% Academic, 24% Big Pharma, and 15% Non-Bio (e.g. semiconductors, cosmetics, food, batteries)

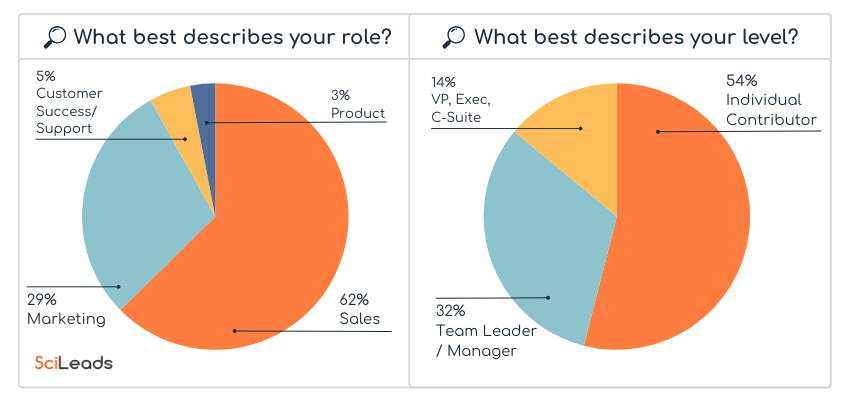

The respondents were primarily sales and marketing, with a small amount of product and customer success. There was great coverage spanning seniority levels and company sizes, giving us a holistic view across our industry.

Respondents were asked about their role (62% sales, 29% marketing, 5% customer success or support, and 3% product), and their seniority level (54% individual contributor, 32% team leader or manager, and 14% VP, exec, or C-suite).

Respondents were asked how big their company is; 32% said 1-50 people, 11% said 51-100 people, 8% said 101-500 people, 15% said 501-10,000 people, and 34% said over 10,000 people.

Challenges and Check-In

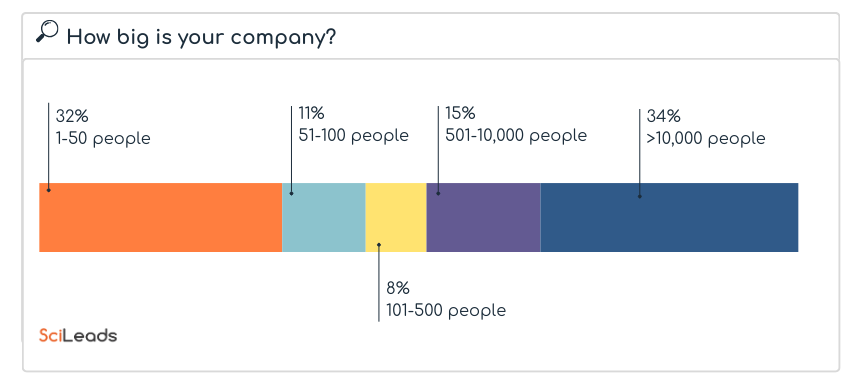

We have to acknowledge that many external factors have brought challenges this year. If you’re feeling the impact of NIH funding changes and tariffs, you’re not alone. 70% of you said NIH funding has impacted your 2025 results, and 66% of you said tariffs have.

Results showed that political events have impacted results in science sales and marketing in 2025, with NIH funding changes and tariffs most often cited.

Your free-type comments echoed this too. While many mentioned the difficult political environment, lots of you spoke with cautious optimism for change, especially regarding VC funding and the biotech sector.

Respondents were asked; “Any other comments about the coming year?” (free type). Replies included;

- “Things will get better in pharma as US pharma investment, CDMO positive events, biopharma funding, and recent US/UK drug agreement – positive indicators for 2026”

- “Big unknowns with potential major disruptions but hope that scientific instrumentation markets will weather the storm well.”

- “We have seen an uptick in Q4. We hope this is the start of the turning point and things will get better in 2026. Or is it just the year end rush and it will remain stagnant in 2026. Still seeing lots of RIFs and closures in the start-up biotechs.”

- “I think biotech will continue in two gears – some big winners whilst many hang on with their fingertips but I expect capital flows to pick up during the year.”

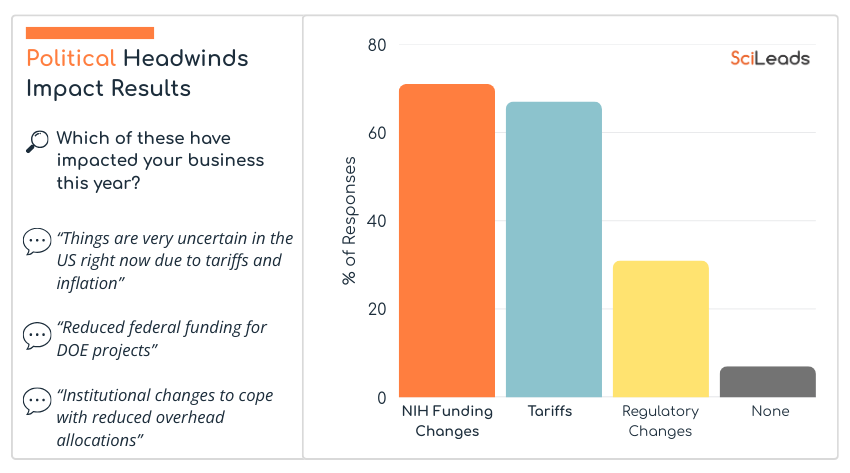

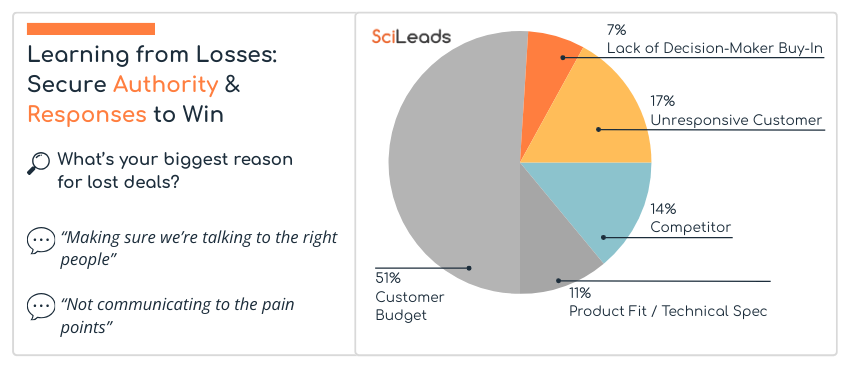

When asking about lost deals, 51% of you said customer budget was the top reason for losing. While we can’t control this, the positive signals in NIH and VC funding for 2026 should help to improve this.

We also see a large portion of lost deals are down to factors that are within our control; lack of decision-maker buy-in (7%), unresponsive customer (17%), and competitors (14%) are all things that as sales and marketing professionals we can influence. Securing decision-makers early, remaining “politely persistent” to get responses, and having a deep understanding of our competitors are things we can continue to improve. In our prospecting section we get into the best platforms and personalization to use for those follow-ups.

Respondents in science sales and marketing were asked; what’s your biggest reason for lost deals? 51% said customer budget, 17% said unresponsive customers, 14% said competitors, 11% said product fit or technical specifications, and 7% said lack of decision-maker buy-in.

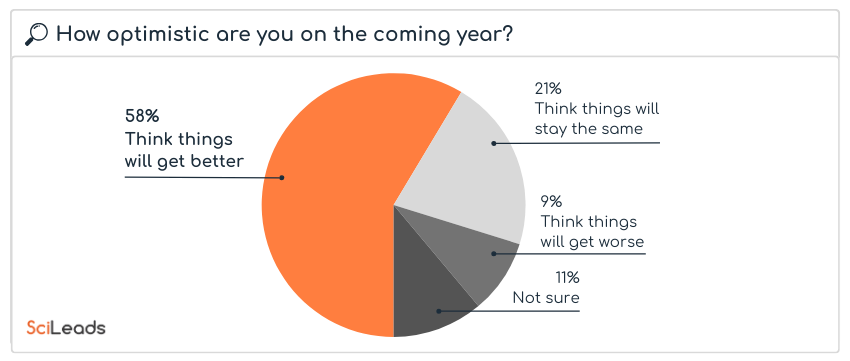

Overall the majority of you, 58%, think that 2026 will be better than 2025 – and only 9% of you think it will get worse.

Science sales and marketing professionals were asked about their optimism for 2026; 58% think things will get better in this industry.

But if you’re feeling stretched, you’re not alone.

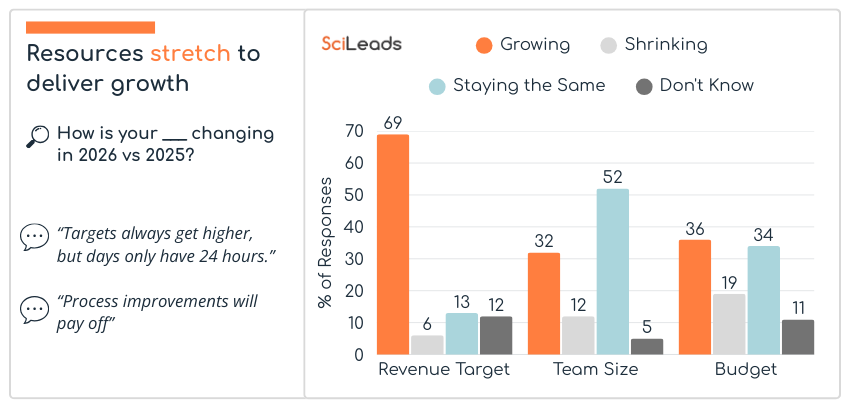

69% of you reported your targets are growing – but only 32% and 36% respectively have their team or budget growing to match. This means doing more with less, and getting ruthless with focusing only on the things that deliver results.

Science sales and marketing teams were asked if their revenue targets, team sizes, and budgets will grow or shrink in 2026 compared to 2025. Most reported growing revenue targets, but steady team sizes.

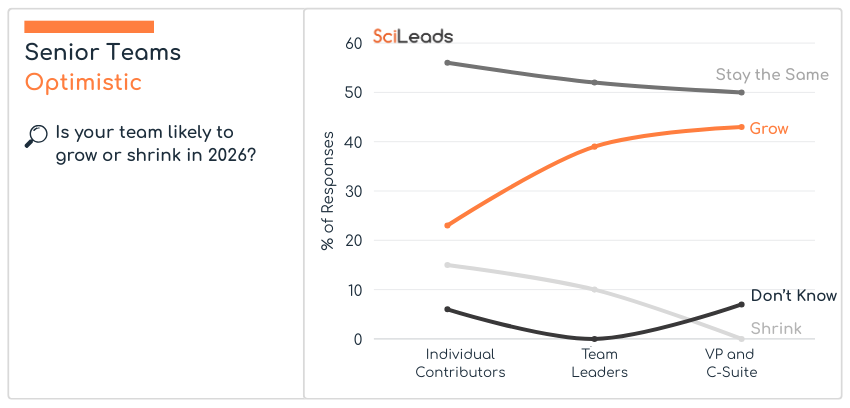

We do see that the more senior you are, the more likely you are to predict team growth, and the less likely you are to predict teams shrinking. This is a really positive indicator that those at the top, typically with the longest term view and deepest overall market awareness, are predicting growth in 2026.

VP and C-suite level people in scientific sales and marketing were almost twice as likely to predict team growth in 2026 as individual contributors.

Pipeline

Within our pipelines, we want to look for the factors we can influence or control.

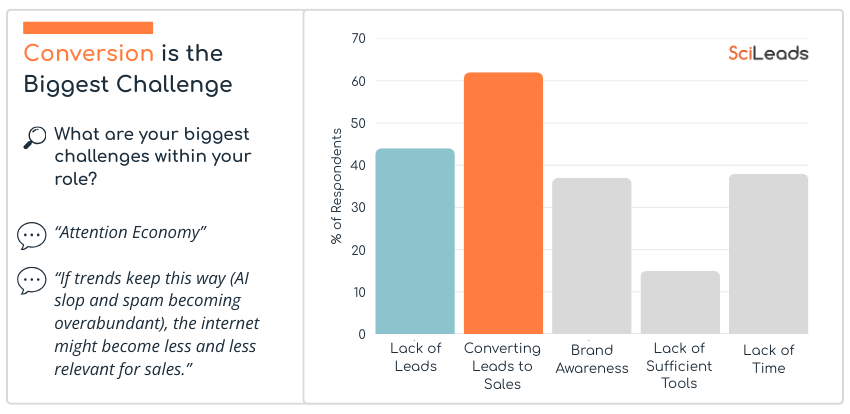

Conversion is the most commonly reported challenge, and comments touching on the difficulty in capturing and holding the attention of our buyers re-confirm it. This echoes the reasons for lost deals we saw earlier; threading in decision-makers and remaining “politely persistent” will be key tactics to drive that conversion. Human connection and clear relevance is also so important here, and in the prospecting section we look at the methods high performers are using to connect with customers.

Science sales and marketing professionals reported converting leads to sales as a major challenge in their role. Multiple answers could be selected on this question.

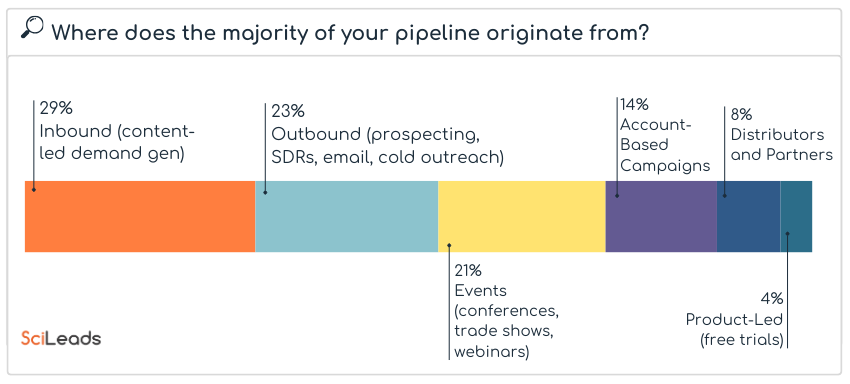

The top lead sources were inbound (29%), outbound prospecting (23%), and events (21%) – but the spread was quite broad. This indicates resilient pipelines that are not over-reliant on one channel.

Science sales and marketing teams reported where the majority of their pipeline originates from; 29% inbound via content, 23% outbound via prospecting, 21% from events, 14% account-based campaigns, 8% distributors and partners, 4% product-led such as free trials or samples.

Prospecting

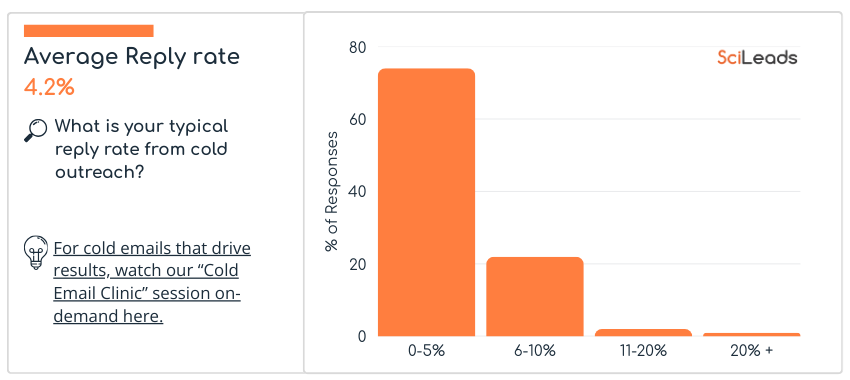

There are many sources online speaking to “typical” email open rates and reply rates. But these vary massively, and include a very broad range of industries and target customers. We wanted to collect a benchmark specific to those selling to scientists.

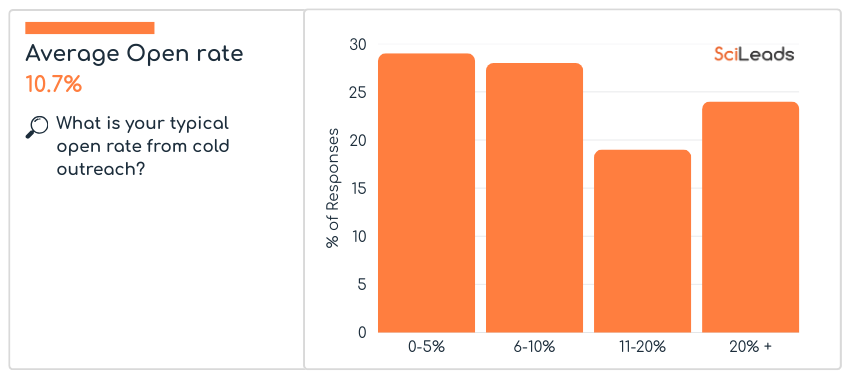

The average open rate for cold emails to scientists was 10.7%, though we can see the spread is very broad. Even within the scientific niche there’s huge variation.

The average reply rate for cold outreach to scientists was 4.2%, and we can see this was less varied across the spectrum.

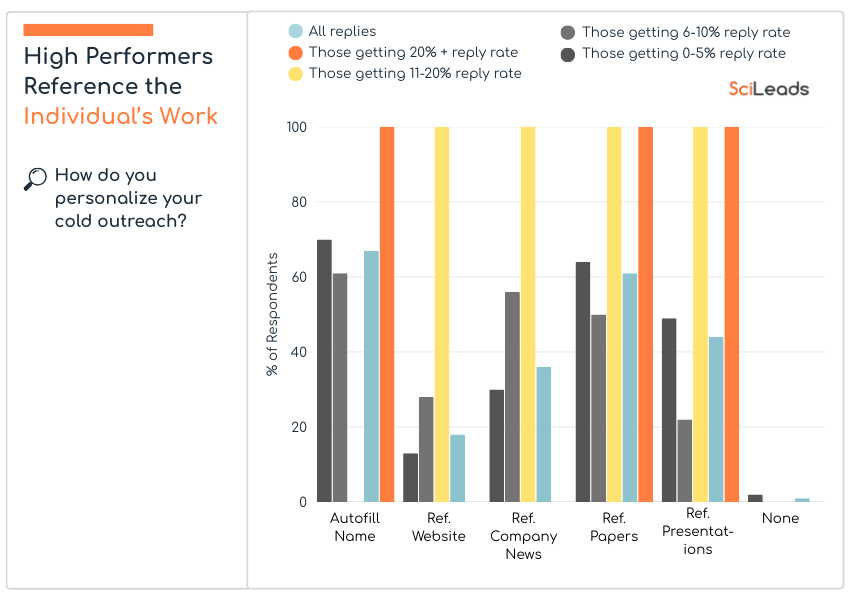

Where written messages are used, personalization is a must. It makes the recipient feel understood, and shows that you have chosen to contact them for a specific reason – both of which boost response rates. When speaking to highly analytical scientist buyers this is especially important.

Personalization means more than “Hi firstname”. In science especially, there is so much information publicly available about the buyer’s grants, publications, and presentations which we can use to understand their work and needs before reaching out.

As well as looking at all responses on personalization, we can isolate those achieving high reply rates. We find the high performers are more likely to use more personalization, and more likely to reference the individual’s work.

This makes sense, since we are reaching out to end users of the lab equipment or consumables, e.g. Dr Clark, the Senior Scientist. She might have no connection to company headlines, or projects referenced on the company’s website – but a paper she authored, or a presentation she gave at a conference? That speaks directly to work she personally delivered – and is more likely to get a response.

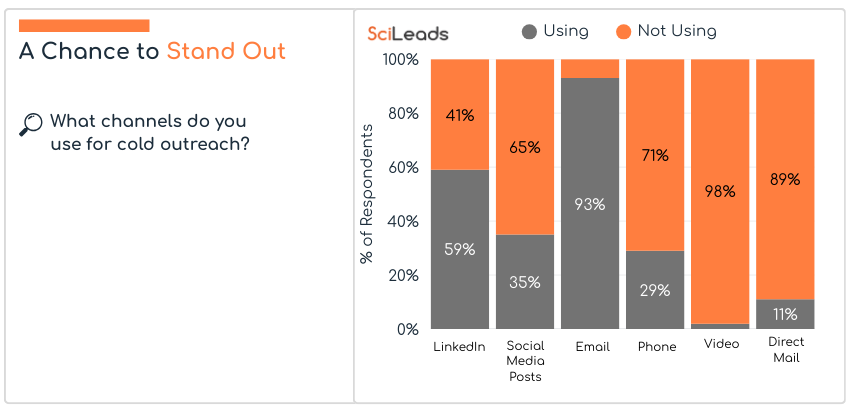

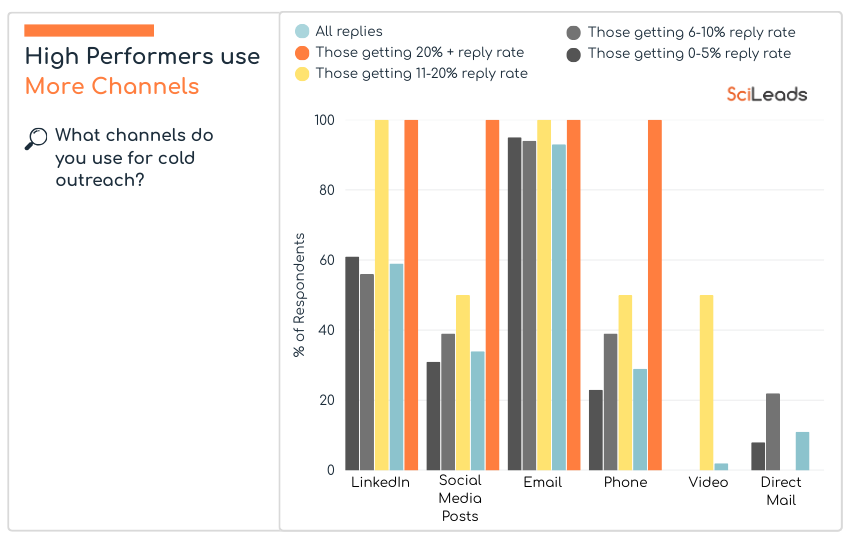

Of course email is not the only route, and when we asked about channels, 59% of you are using LinkedIn messages as well.

We can look at these data and see opportunity; 71% of people are not bothering to pick up the phone, and 98% of people are not sending video messages. This is particularly interesting given that “unresponsive customer” was the top reason for lost deals for 17% of you – using phone calls or video notes to show you’re a real human makes it much more difficult to ignore you!

But a channel being little-used doesn’t necessarily mean it’s good – so what are the high performers doing?

When we cross-reference channels with the reply rates, we see that those getting 11%+ replies are more likely than average to use phone, LinkedIn, social media posts, and video.

They are also using a wider range of channels, and this makes sense – each serves a unique purpose;

- LinkedIn and Email – personalized messages and nudges.

- Social media posts – showing up in your ICP’s feed with news or tips; subconsciously associating your name with being useful.

- Video – personalized message with a clear human face and voice.

- Phone – 2-way conversation with clear human input.

💡 How to post on LinkedIn to engage and connect with scientists – watch the webinar here.

Events

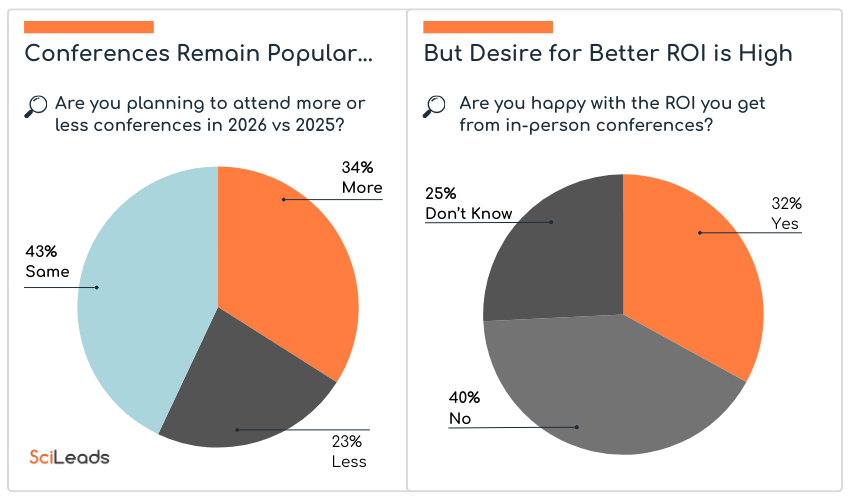

Turning to events, 77% of you report that you are attending at least the same or more conferences in 2026 vs 2025. In itself this isn’t unusual, but actually only 1/3 of you are happy with the ROI you’re getting.

Science sales and marketing professionals were asked about their use of conferences; 34% said they will go to more in 2026 vs 2025, and 43% will attend the same number. However only 32% are happy with the return on investment they are getting from conferences.

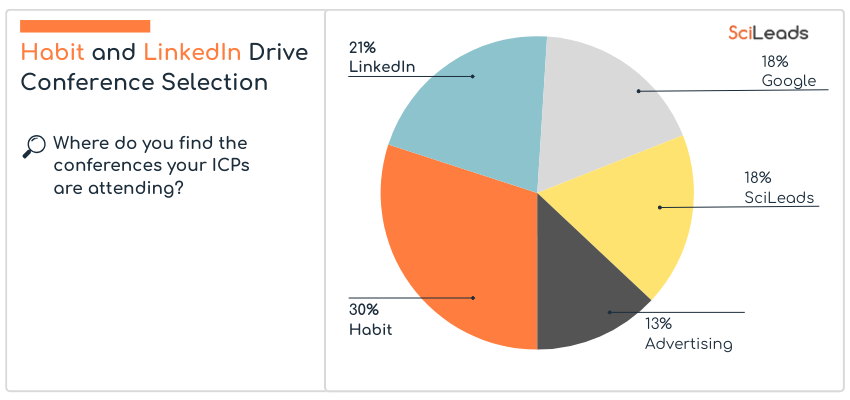

You also revealed that 30% of the time conferences are chosen simply out of habit! The next most popular sources are LinkedIn, then jointly Google and SciLeads.

Most science sales and marketing teams choose the conferences they will attend out of habit, followed by LinkedIn, Google, and SciLeads.

💡Get a free report of the conferences that best match your scientific keywords here.

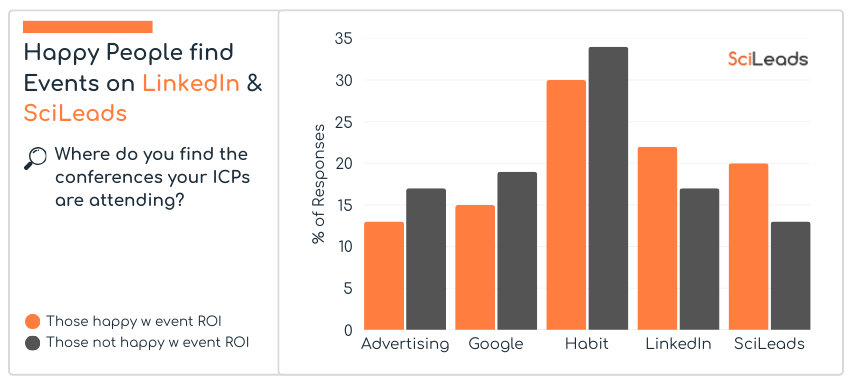

While there is some merit in building familiarity and seeing the same audiences by repeating events, those unhappy with ROI were more likely to attend events out of habit. This is a factor in your control; review the results, and consciously select events that match with your goals!

Those finding events on LinkedIn or SciLeads were more likely to be happy with ROI; potentially because these are more likely to be popular (talked about on social) or relevant (high keyword-match) respectively.

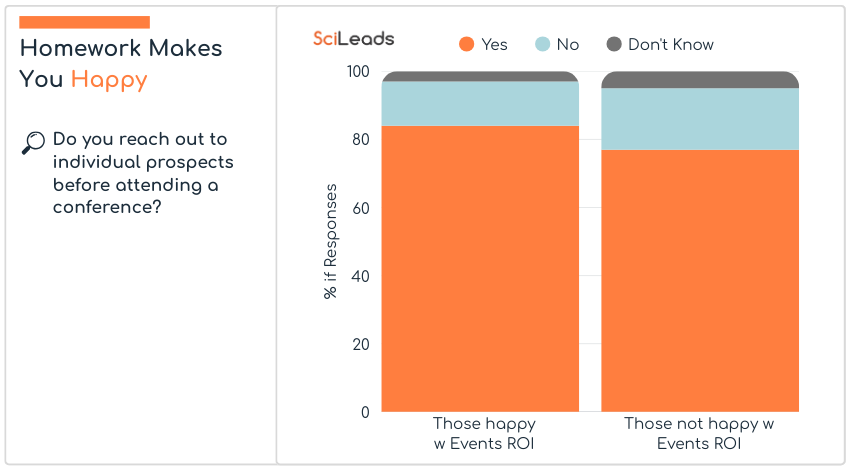

We asked if you reach out to prospects before events, and it was no surprise that those happy with events ROI more often do outreach beforehand. If you’re not already doing it, try it for your next conference and see the difference.

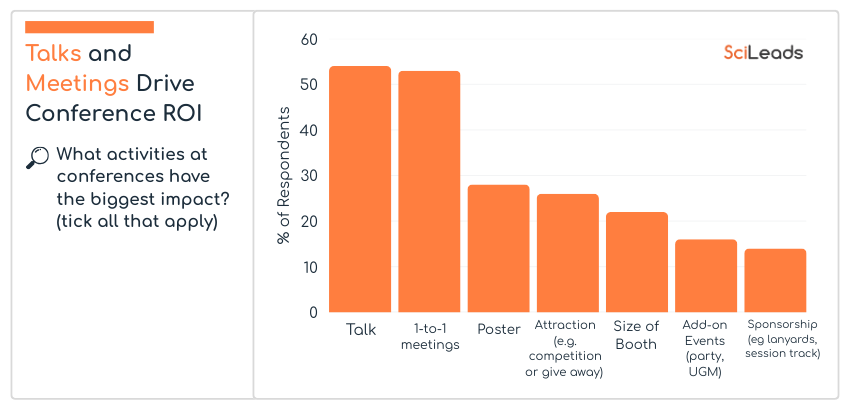

When it comes to making an impression at conferences, most of you reported that talks and 1-to-1 meetings have the greatest impact.

Marketing

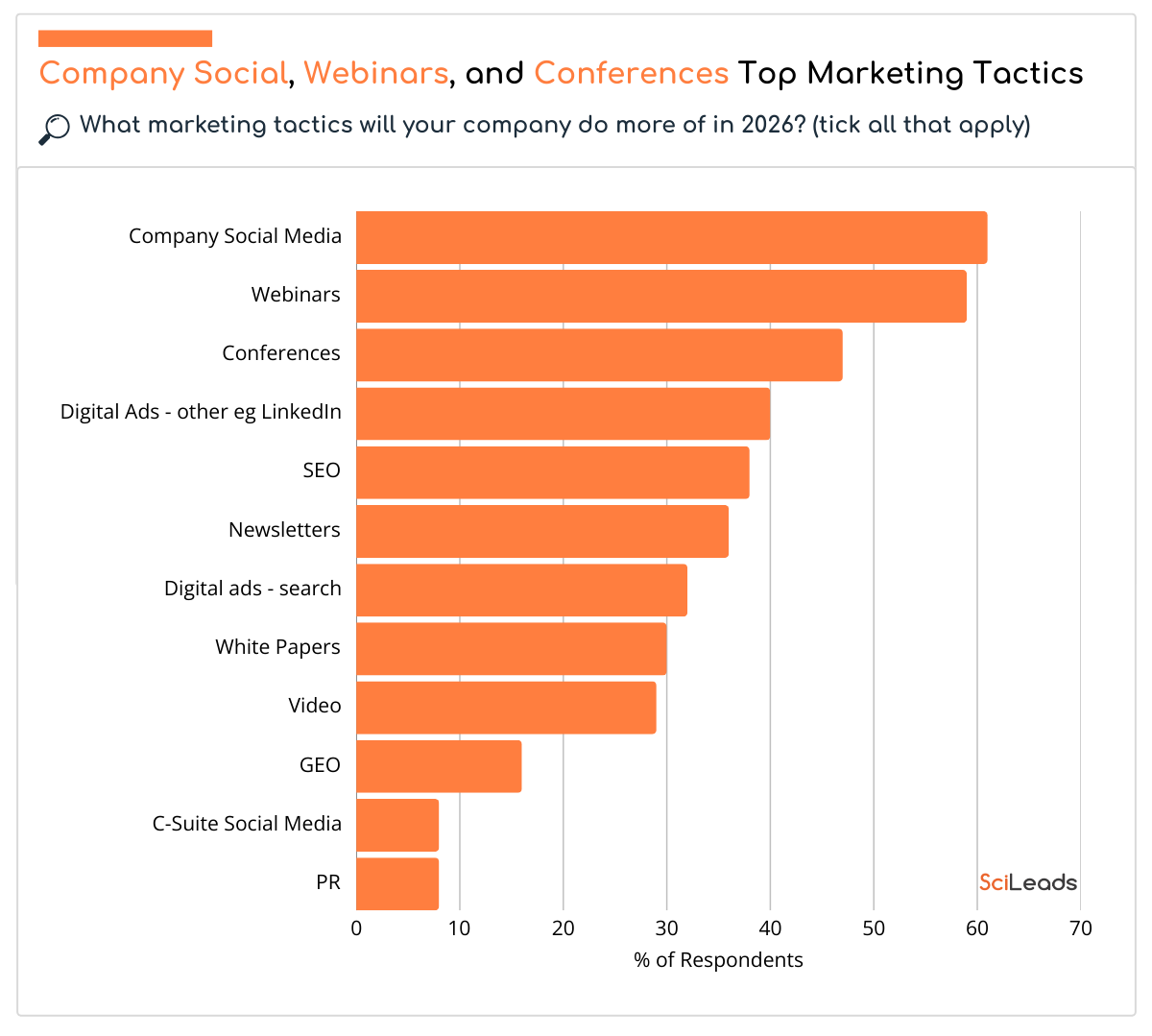

For science marketing tactics in 2026 social media, webinars, and conferences ranked highly.

We were interested to see that C-suite social media was not more popular, given its increasing prevalence in other industries. The prospecting section showed that high performers use social media posts in their mix. We spoke with guests who are effectively using LinkedIn to connect with scientists on our webinar, so see this for more detail.

💡Using LinkedIn to Connect with Scientists – watch the webinar here.

Tools & Tech

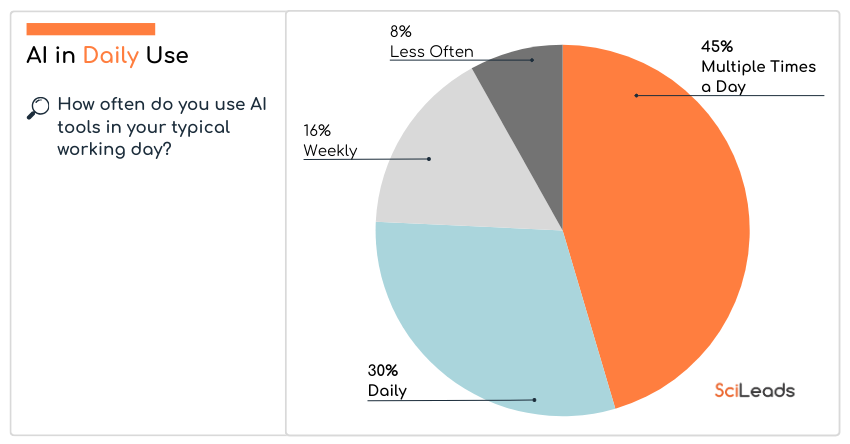

When it comes to tools, the vast majority of you reported using AI at least daily. If you’re not already using AI somewhere in your work, it’s time to try it.

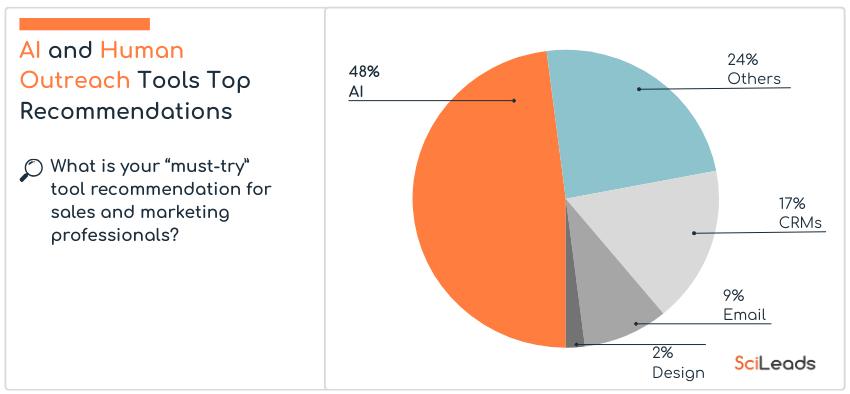

When we asked for your recommended tools, AI topped the board – but many of you mentioned tools and practices rooted in human connection. In the free type comments we found “humanity” and “deeply personalized outreach” alongside platforms like SciLeads and Sales Navigator – again returning to the value of authentic human connection that we found in the prospecting data.

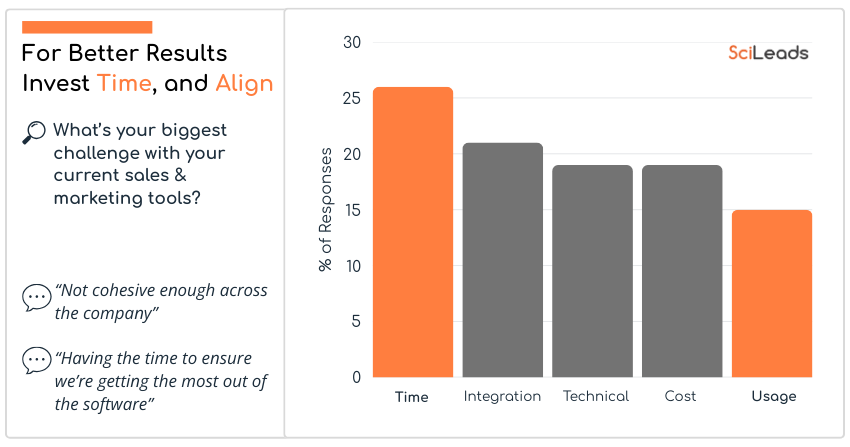

We then asked what your biggest challenge is with using these tools, and this was a free-type question. Many of you spoke about technical aspects of platforms, or costs, which we can’t really influence as users.

However, time and usage were often cited too; together comprising 41% of responses.

For these, we can exert influence. Conducting focused trials, with a specific goal in mind, and adequate time to test will let you discover what works best.

Rolling out the winners to the whole team is then vital, to multiply that success. Many of you commented about different people having their “pet platforms” and feeling splintered. We have seen great results among SciLeads users when whole teams or departments all use and understand it; it means there is a cohesive strategy and uniform approach, which positively impacts brand reputation as well as results.

Recommendations

Overall these results show that science sales and marketing teams are cautiously optimistic for 2026, and we can still see many factors within our control that we can change and improve.

Our top recommended actions from these results are;

- Continue with emails – remaining politely persistent to get that response, and personalizing with the individual’s work rather than company-wide news.

- Use LinkedIn, Social Media Posts, and Phone Calls too – to spread your reach, build your reputation, and show your human side respectively.

- Choose conferences wisely – using LinkedIn and SciLeads, not just habit!

- Get the best ROI from events by reaching out to prospects beforehand, and having a talk where possible.

- When evaluating new tools, carve out time to experiment – then double down on winners, rolling them out team-wide to multiply that success.

💡 For cold emails that drive results, watch our “Cold Email Clinic” session on-demand here.

Appendix

We asked for your “must-try” recommendations for sales and marketing professionals – here they are. Some were recommended many times (ChatGPT, SciLeads, HubSpot) but we have listed them just once here for clarity.

- ChatGPT

- SciLeads

- Hubspot

- Hubspot Sequences

- Zoho- CRM

- Lovart for communications and design; any LLM for promotional emails

- coral.ai

- Deeply personalized outreach

- Google Gemini

- Juma

- Qualified AI SDR Platform

- Outreach.io

- CoPilot

- SEMRUSH competition analysis

- hunter.io for email retrieval (when not found on SciLeads)

- Besides SciLeads, I would say sequencing. Personalized one-to-one emails generate more leads than traditional marketing emails. Companies should be doing both.

- Automa (web automation for prospecting)

- NotebookLM (for paper summaries)

- Google Notebook

- Some form of mail merge, recording to SFDC.

- AmpleMarket

- Sales Navigator

- Humanity

- Hubspot integrations, and maply

- Perplexity